If you’re a salon professional, then you’ll frequently be purchasing new products and equipment for your daily work; then, for such purchases, the salon credit card is a great option that can help you save some money and get additional benefits whenever you pay through a salon-centric credit card.

SalonCentric is an online marketplace where customers can look for barber services and purchase personal grooming products. To give a smooth and hassle-free experience, SalonCentric has partnered with Comenity Capital Bank to provide credit payment options to salon merchants.

In this article, we will look at SalonCentric credit card payment options and the various benefits salon merchants can avail of by using this card.

How does the SalonCentric Credit card work?

SalonCentric Credit card is specially designed for authorized beauty professionals. This card comes with several benefits, and they can be availed while making purchases at SalonCentric offline locations or online at SalonCentric.com.

SalonCentric card provides their customers with 24/7 access to their accounts. With the SalonCentric card, you can easily pay your bills, check all your transactions and total balance, and much more.

A SalonCentric card can be accessed 24 hours a day throughout the week for making your payments and managing account diaries. The platform also ensures full security, confidentiality, and an easy user interface for the customers.

SalonCentric Credit Card Benefits

SalonCentric card benefits include interest-free financing for up to 12 months, which depends upon your eligibility and the size of your purchase, which is quite useful sometimes when you require a product and need some more time to pay off the bills.

Along with this, some of the additional benefits that SalonCentric offers are:

Superior Customer Service:

- You can get help and solutions to all your queries a 24/7 customer service support

- You can resolve all your queries by contacting this SalonCentric credit card’s customer service number: 1-877-250-9215

Trusted security features: SalonCentric also has a suite of security components that ensures the safety of customers’ cards and payment information. Some of their key security features are:

- You’ll get immediately notified if a suspicious transaction gets noticed on your account

- Pay securely with virtual card numbers for all your online purchases

- Immediately block your card from the SalonCentric app if it gets lost or stolen

SalonCentric Credit Card Rewards

Other than the financing options, the SalonCentric credit cards also provide multiple reward points for every purchase you make. These points can be later redeemed for rewards such as free products, discounts on future SalonCentric items purchases, and exclusive promotions.

There’s no limit on the number of bonus points you can collect. And these points will not expire until you’re keeping your card in good standing by paying off the bills within due periods.

Some of the rewards that SalonCentric offers are:

- 20% off on your first purchase (When you open and use the SalonCentric card the same day as an account and provide a coupon code along with account details)

- A $10 Reward for every 250 points earned with purchases from your SalonCentric credit card

- A flat 20% off on the Educational classes purchase on your SalonCentric credit card.

- An extra 5% off on Shop and Learn events with a purchase on the SalonCentric credit card (offer is limited to participating Shop and Learn brands only at SalonCentric)

SalonCentric Credit Card Eligibility Criteria

Certain conditions need to be fulfilled if you want to apply for the SalonCentric credit card. First of all, you need to be of 18 years of age and in possession of a current Social Security number to be eligible SalonCentric credit card.

For getting your card authorized, the basic requirement is you need to have a strong credit history. People who frequently keep making purchases from SalonCentric will find this credit card very useful.

Your credit score is also checked when you apply for the SalonCentric credit card. This score helps companies know how responsibly you have used your credit cards for the past months/years. If your credit score is less, you can increase it first and re-apply for the SalonCentric credit card. To increase your poor credit score, you can use those credit cards issued by their companies, even with some low credit scores.

Just like other credit cards, it’s important to use this card responsibly too, by paying off the monthly balance in full before the due dates, so that this card can not only provide you reward points on every purchase but also will help you to build a good credit score

How to get a SalonCentric account?

You can create a new account by following the below step-by-step process:

Step 1: Visit the login page of SalonCentric Credit Card:

Step 2:

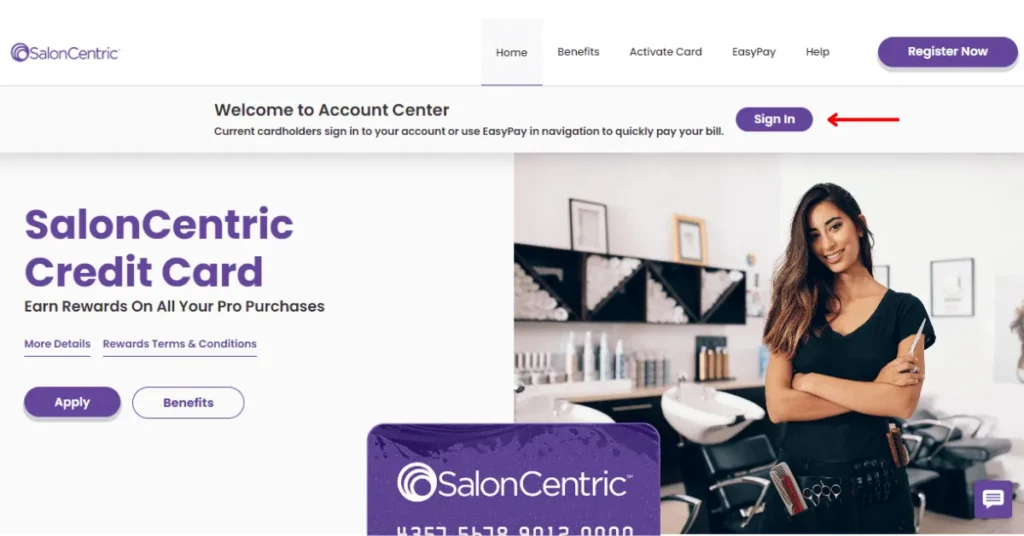

a) If you’re an existing user, then, Click on the “Sign In” button, visible at the middle of the page

Now, you can enter the required details like user ID and password to enter the account

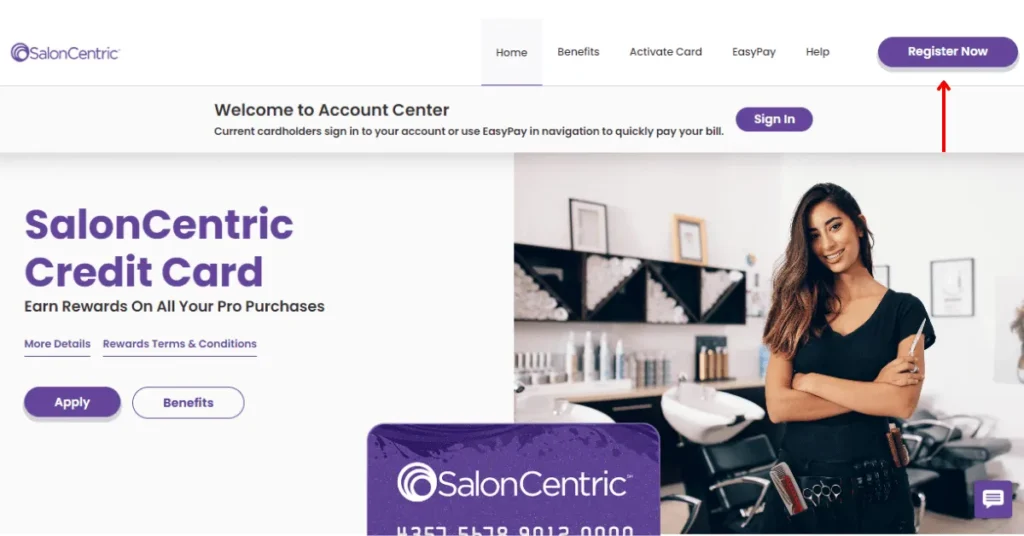

b) If you’re a new user, then, Click on the “Register Now” button, visible in the top right corner

Here you need to provide some basic information such as your name, Social Security number, address, and annual income to open a new account. Apart from this, you may also be asked to provide employment and housing information.

Step 3: When you’ve filled in all the information, you can submit it online, and then the company will go through your submitted details and will give you a decision. If your SalonCentric credit application gets approved, then you’ll receive your SalonCentric credit card online in the mail within 7-10 business days.

Things you need to know before applying for a SalonCentric credit card

- It’s mandatory to read all the terms and conditions along with the legal documents’ disclosure of the SalonCentric credit card to get an idea of its interest rate, reward program, and any additional fees. Also, make sure that you fully understand its potential drawbacks and features or benefits so that you can use it smartly and make the most out of the SalonCentric credit card.

- This card provides the most benefits for salon professionals, so it is specially designed for them only. This card comes with multiple benefits and rewards for salon and beauty-related items purchases, which is why this card comes among the 1st choice for salon professionals.

- If you own a SalonCentric credit card, the discount and special offers are only available for you, which means the cardholder only.

How to activate your SalonCentric credit card

If your card application is approved and you have been issued a new SalonCentric credit card, then you must activate it. Here’s the step-by-step procedure for activating your card:

Step 1: Visit the SalonCentric credit card activation page

Step 2: Input your Primary Cardholder Information, such as

- Credit Card Account Number

- Expiration Date

- Social Security Number (SSN)

- Last Four Digits of the SSN

- Zip code or Postal code

Step 3: Now select Customer Service from the menu bar and then select Self-service

- Select Activate card option under the Credit/Charge account section

- Finally, Enter the Crad info and follow the prompts and finish the activation process

Important points to note about SalonCentric Credit Card

The SalonCentric Credit Card can be a smart choice to get more cashback if you frequently purchase saloncentric items. But it’s equally important to use it carefully, just like other credit cards; that’s why below are some of the points you need to keep in mind to get maximum benefits from the card:

Interest rates and Late fees:

While using any credit card, it’s important to understand the interest rate and late fees the card charges if payment gets delayed.

The late fees charged on the payment depend upon many factors, such as the duration of the payment delay, your credit card standings, and many other similar factors. To get a clear idea about the late fees and interest rates, contact the bank directly so you can understand everything in detail.

No specific interest rate number is mentioned on the website of SalonCentric Credit Card. But the interest rate for this card type will be very similar to the same type of cards in this category. The overall APR for this card is roughly close to 27.49%

To know more about how the interest rates and late fees work on the credit card you can visit our previously written in-depth article.

Salon Centric Credit Card Annual Fee:

Many credit cards in the market come with multiple rewards and benefits, but to own them, you have to pay some annual fees.

But the Salon Centric Credit Card has zero Annual Fee.

Online account Management tools:

For the convenience of the customers, SalonCentric offers a wide range of online account management options. It provides customers with 24/7 access to their accounts to keep track of their purchases, check the available balance, etc.

You can also set up automatic alerts or reminders for your payments so that you can make payments properly and on time.

SalonCentric Credit Card’s Pros and Cons:

Let’s now discuss the various pros and cons of the SalonCentric Credit Card.

Pros:

- Easy and Hassle-free application process

- Interest-free financing for up to 12 months

- Special financing options available on purchases of $500 or more

- Earn reward points on every dollar that you spend

- No annual fees

- A special suite of security components to ensure the safety of customers’ cards and their payment information

- Special discount offers and promotions to salon professionals

Cons:

- The card can have limited usability outside of offline SalonCentric stores.

- Not paying monthly bills on time can lead to higher interest rates and late fees, so make sure to pay your bills before the due date.

- If you are carrying a balance on your credit card every month, then you can be charged a high-interest rate of 27.49%

- To become eligible to own a SalonCentric credit card, you must have a good credit score.

Conclusion

The SalonCentric credit card can be a very good choice for licensed salon professionals who frequently shop SalonCentric products at their offline stores or online. The reward points, special offers for salon professionals, etc., make it an attractive option for those who want to save money on their beauty products or equipment purchases.

However, before making a final choice to apply for this card, it’s equally important to understand its eligibility criteria and its benefits and drawbacks so that you can make a smart choice while choosing the right credit card for you.

If you have any other questions, then visit the Help section of the official SalonCentric website to resolve all your queries.

If you liked this article then kindly consider rating this article with the stars rating option available at the top or bottom of the article. If you have any questions or suggestions then please let us know through the comments.

FAQ’s

How to access the SalonCentric credit card?

Users can easily access the SalonCentric credit card account by following the below process:

– Visit the Offical website

– Enter your User ID and Password

– After that, click on the login button to access your account online

How to check SalonCentric credit card balance?

– You can log in to your account by visiting the official website

– Then after doing the login, you can check your balance

How to pay bills online using a SalonCentric credit card?

– Login to your account by entering account details

– Then go to the payments tab

– Now click on the Make payments Button

– Now enter the payment details

– Finally, verify your payment details and click on submit button

What is the SalonCentric credit card customer care number?

SalonCentric credit card’s customer care number is: 1-877-250-9215

1 thought on “SalonCentric Credit Card Review | Rewards, Login, Payment”