Are you searching for a new credit card that will help you build your credit score, Will help you pay your general bills on time, and will also remind you to pay the credit card bill At the right time? Then Onmo credit card will be the best choice for you!

Onmo has gained so much popularity in the UK Credit card market due to its easy approval process and transparency on its credit card charges/fees and fixed APR. Many people have also reported that they got approved for the credit card within minutes of application, so not having very strict eligibility criteria to apply for an Onmo cards has Made this credit card an easy choice for customers.

This detailed Onmo Credit Card Review article explains everything you need to know before applying for this credit card. Let’s delve into this article to help you decide whether this Credit Card is the right choice for you or not.

A Quick Onmo Credit Card Review

Let’s take a glance at the features of the this Credit card.

- Easy Approval Process

- Intuitive App dashboard – Where you can view all your Onmo activity in one place

- Fixed APR and No Hidden Charges – All the outstanding charges/fees can be easily seen from the app

- Helps to improve your credit score – Onmo proactively enables you to build your credit rating, reducing APR (and charges) over time. Onmo’s app can alert you of activity that may negatively impact your Credit Score or incur unwanted charges – for example, exceeding your limit or failing to make timely payments.

- Set up one-off payments, standing orders, or Direct Debits.

- Authorized and regulated by the FCA. Reg number: 940604

APR and Transaction Fees –

| Card Issue Fee | £0 |

| Representative APR | 29.99% |

| Balance Transfer Fee | NA |

| Minimum Eligibilty Age | 18 |

| Minimum Income | NA |

| Minimum Credit Limit Starts From | £250 |

| Overseas Transaction Fee | 2.99% |

| Domestic and International ATM withdrawal (exclusive of ATM operator fees) | 3% of withdrawal amount with a minimum fee of £3 |

| Foreign Exchange charge | 2.99% on top of Visa exchange rate |

Who is ONMO LIMITED?

Onmo is one of the UK’s newest credit and debit card providers, incorporated on June 30, 2020. It began to trend in the UK credit card market in early 2022, and since then, people have been enjoying using Onmo as their go-to card.

Onmo’s products are easy to use and transparent with their charges, as the company puts customers first than their profits! ; this is more important to us as credit card users because nowadays, every company keeps charges hidden from the customers, and by the end of the month, customers get shocked by saying the charges on their bank statements.

If we talk about the authenticity of this company, then let me tell you that Onmo Ltd. is an authorized company regulated by the Financial Conduct Authority (FCA). The company is registered in England & Wales (With Number 12708619), and its headquarters are at 33 Cannon Street, 4th Floor, London, England, EC4M 5SB.

Transact Payments Limited issues an Onmo Visa card (their credit card). Transact Payments is authorized and regulated by the Gibraltar Financial Services Commission. An important thing to note is all your Account balances will be held with PayrNet Limited, an authorized Electronic Money Institution (EMI).

Now with all these details shared about the company, you can also keep your trust in this company and its products!

As we have seen what Onmo company is now, let’s understand how their credit card works.

How does Onmo Credit Card work?

As Onmo launched its Credit Card in the early days of 2022, Since then, it has gained popularity among consumers for its unique features, benefits, and rewards programs. Onmo has beaten the competition with its unique card features and excellent customer service, making it a competitive option in the credit card market.

Now let’s understand what features Onmo provides with its credit card.

Flexible limits, from £250

As only an individual’s credit score can’t determine a person’s financial discipline, Onmo uses smart tech and data to determine the right APR and credit limits for every individual.

This differs from traditional credit cards, where the APRs are fixed no matter how much you spend with the credit card.

The maximum Onmo credit card limit can go up to £5K, but we can’t say £5K is the ultimate limit Because this limit depends upon your annual income and credit score.

To get a rough idea about the maximum credit limit you can get with this card, contact their customer service and get more details.

A transparent approach to Interest Rates and Fees

The Onmo app clearly shows the recent transactions, ongoing interest rates, and outstanding fees; this helps card users know exactly how much they spend on credit. To not shock the users at the end of the month, Onmo updates its Interest rate daily; this is another great example of how much Onmo cares for its customers.

Have Complete 24/7 control over your spending

Onmo’s app Helps to keep you in control of your spending limits and payments. It tells you exactly where your money is going, freezing your card when required and setting reminders so you will get all bill payment dates.

Also, if you use multiple Onmo products, this app will help you see your view and control everything in one place.

Does Onmo Provide any Rewards for using their Cards?

Currently, Onmo provides only one reward program in which customers can get more Reward points on their purchases, which can later be redeemed for various benefits such as travel vouchers, merchandise, or statement credits, providing additional value for cardholders.

As Onmo Credit Crad’s customer base is increasing daily, they will also develop a new rewards program in the coming days.

Also, Onmo’s Proactive help to their customers improve their credit rating with their in-app alert system is no less than a reward because so many people struggle to increase their credit card scores despite having good financial discipline.

Check your Eligibility for Onmo Credit Card

By looking at the current examples of the people who got approved for Onmo credit cards, we can say that if you have a good credit score within a range of between 580 to 669, with a history of making regular payments, you can easily get approved for this card.

Although no specific credit score or income range has been mentioned on Onmo’s official website, if you want to apply for this card, you can contact their customer care and share your required details. They will be able to tell you whether you can get approved for this card.

The basic Eligibility criteria to apply for the Onmo Credit Card are as below –

- Your age must be 18 or over

- You must be a resident of the United Kingdom with a permanent UK address

- Must not have had any CCJs, IVAs, or defaults in the last six months

- A good credit score and credit bills payment history

- Must not be declared bankrupt

To learn more about the correct and efficient use of Onmo credit and debit car, you can visit the terms and conditions page of the official website.

Have you ever heard about getting a title loan on your used car? If not, let me tell you that a new company called Yendo offers up to a $10K credit limit by using your used car as collateral. Want to know more? Please read our detailed article on Yendo Credit Card.

How to Apply for Onmo Credit Card

You can apply for an ONMO Credit card through a credit referencing agency such as Totally Money, Experian and Clear Score. You can visit the websites of these agencies to submit your application to get approved.

Before submitting the application form you’ll be asked to check your eligibility for the card, once you qualify all the necessary requirements then you’ll be asked to fill out the application form.

Now, if you don’t want to go through the hustle of finding the landing page of these agencies to apply for the Onmo card then you can simply head over to Onmo chat support and ask for the landing page link. The process to connect with onmo chat support is explained below.

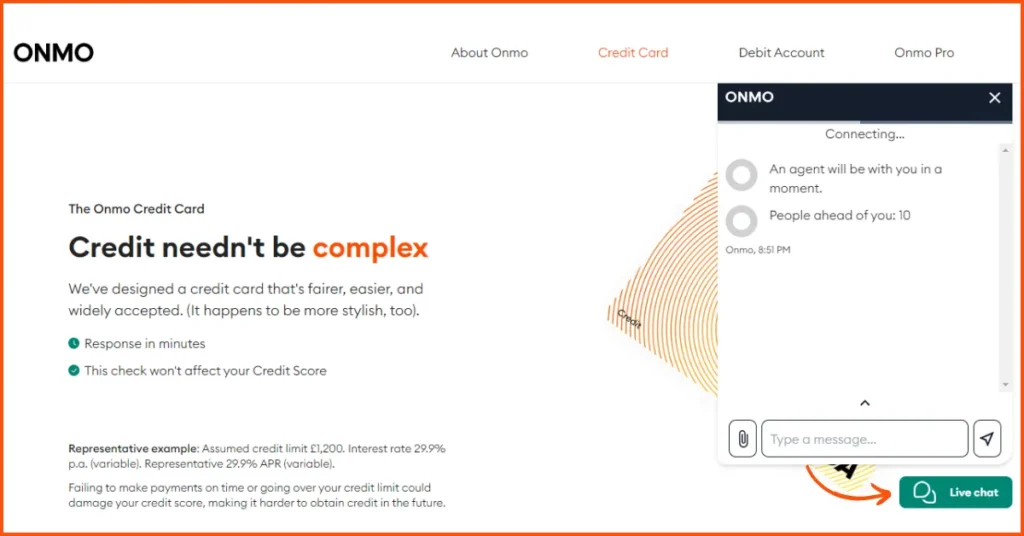

You can visit their Credit Card application page and start a chat with their customer service, here you can ask for the credit card application link.

Here is how you can start the application process –

Step 1:

Visit the official website and click on the credit card option

Step 2:

Go through the details on this page to learn more about the credit card and Click on the live chat option available at the bottom of the page.

Applying Onmo Card from Credit Referencing Agencies

You can apply for the card from Totally Money, Experian and Clear Score. Here we’ve explained how you can apply for Onmo cards from Totally Money.

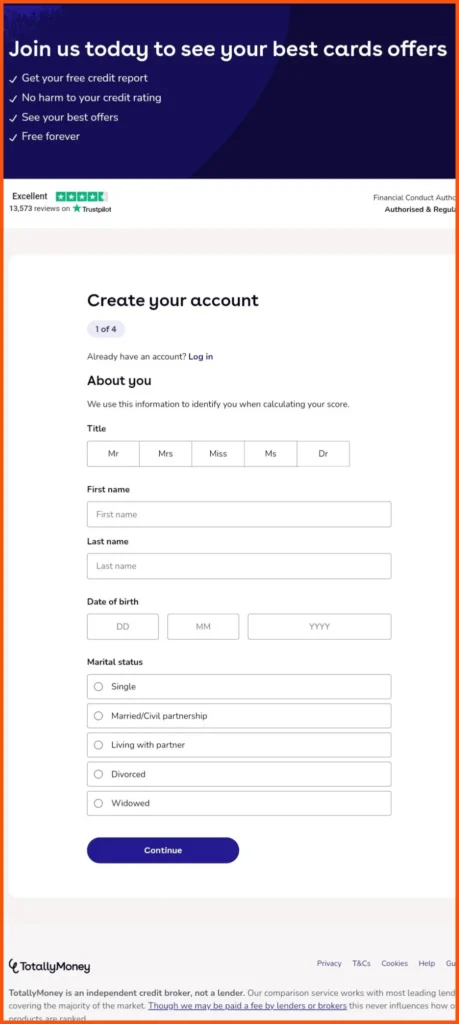

To start your application, you will need to visit Totally Money Onmo Credit Card application Page. Then click on Check my eligibility, after which the below process will get started.

Step 1:

Answer some basic questions about you.

Step 2:

Provide a valid UK address in this step.

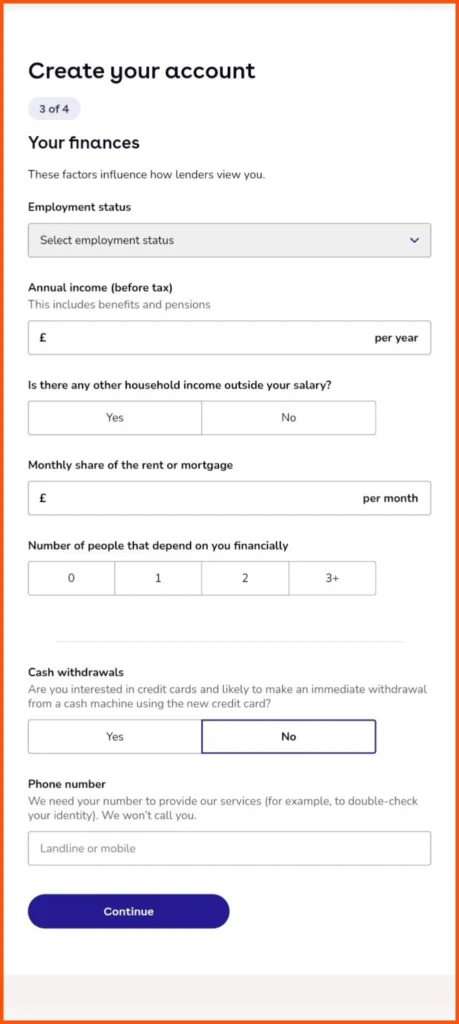

Step 3:

Financial information will be asked to decide your credit limit.

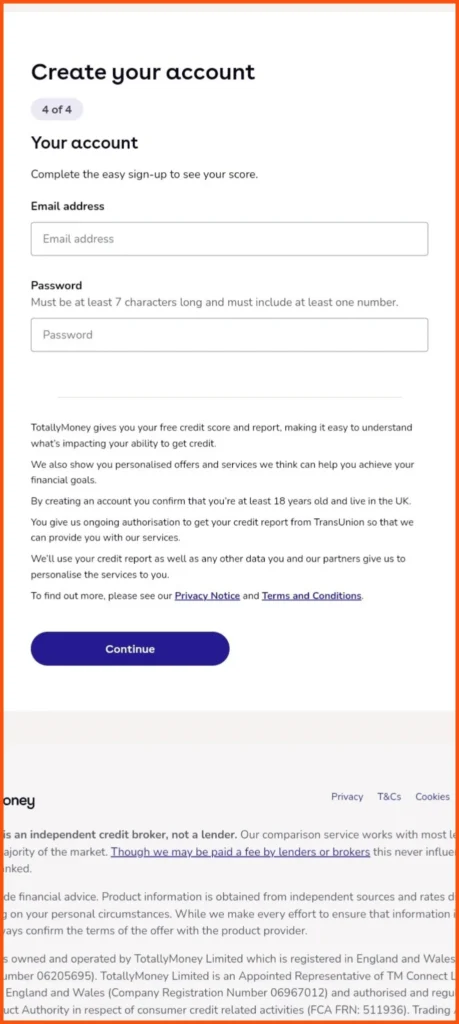

Step 4:

Finally, you can input this basic information and you can check your eligibility & once you’ll see that you’re eligible for the card, you can submit the application. You can expect to receive your card within seven to ten working business days.

How to apply for an Onmo Debit card?

Applying for an Onmo debit card is also the same as above. You can visit the debit card application page and click on the live chat option to submit all your details; after that, the representative will check your eligibility, and if everything goes well, you will get easily approved for the debit card.

Once you’ll order the onmo debit card this how it will look like.

How to Activate Onmo Credit Card

You can activate your Credit Card from Onmo’s official app. Here’re the steps you can follow to activate the card

- Download the app and Log in with all the required details.

- Once you Log in, follow the prompts from the app, which will guide you through the activation procedure. Your PIN will be provided via the Onmo App only.

- Once you submit the required details, the company will do a verification check (KYC); once you get verified, the card will be activated, and you can use it.

If you are still waiting for a pin on the app or are facing difficulties while activating your credit card, we advise you to contact Onmo’s customer care service; once you connect with the representative, they will start the card on the call itself. As so many people have faced this issue and found out, the easiest way to activate the card is by calling customer care service only.

Credit Limit, APR, and Late fees

It is essential to know the maximum credit limit, APR and the possible late fees for the card we are using, so in the case of the Onmo, here are the details of APR and the late fees they charge.

Credit Limit – NA

- As the credit limit depends upon your annual income and credit score

APR – 29.99%

- This is a fixed APR for everyone using an Onmo credit card. This fixed APR is part of their transparent charging policy.

Late Fees – NA

- Onmo hasn’t specified late fees on the website for making late payments. However, their app tells you exactly the expenses you must pay if you fail to pay your credit card bill on time.

Also, you can get more details about other Fees and Card limits that comes with this credit card from the below chart –

You can find all these details on Onmo’s terms and conditions page.

Have you ever seen an unauthorized charge from WUVISAAFT? If not, read this article to protect yourself from potential scams.

Onmo Credit Card Cash Withdrawal

You can withdraw cash from ATMs using Onmo Credit Card. However, as with every credit card, cash withdrawals are subject to certain charges.

Onmo has mentioned on their site that the Maximum number of ATM withdrawals within one day should be five or less than that because if you cross the limit, then you’ll have to pay respective fees/charges.

It’s advisable to review the terms and conditions of the Onmo to understand the applicable fees, limits, and any other considerations related to cash withdrawals.

Perks and Drawbacks

Let’s see the perks and drawbacks of the Onmo Credit Card.

Perks –

- Quick and Easy Credit Card approval

- Helps you build a good Credit Score

- No Hidden Charges, A fixed 29.99% is applicable on all types of transactions

- Intuitive App dashboard where you can view all your Onmo activity in one place

Drawbacks –

- Limited Rewards Program: Currently, Onmo does not provide an exciting rewards program compared to other credit cards in the market; this means cardholders may earn fewer rewards or have fewer options for redemption.

- Higher APR: (current – 29.99%) Although the Interest rates are consistent, customers will still have to pay bigger bills because of higher APR.

- You should be a resident of the United Kingdom with a permanent UK address.

- A good credit score and credit bills payment history

What if you missed the payment or were unable to make payments?

If you can’t pay bills from your card or your credit bill payment is missed, you should immediately take prompt action to solve this issue. You should contact Onmo’s customer service, tell them the case, and they will help you solve the problem.

However, as with every credit card, missing payments lead to unwanted charges from Onmo, so please make sure to pay your credit card bills before their due date.

There are no specific late fee dates applicable for missing payments. Hence the late fees also vary as per the spending done from the card.

Onmo Customer Service Contact

If you are facing any difficulties while activating the card or if your Onmo Credit/Debit card is not working because of any unknown reason, then you should get in touch with customer service, as their customer service response is very fast, so you can expect the first solution to your problem.

Also, even if you’re facing any difficulties with Onmo’s Debit Card, you can use the customer service contact details below.

You will find the contact number in the details given below,

Headquarter Address:

Headquarter Address :

Website:

Contact Email:

help@onmo.app

Phone Number:

0330 333 6000 (Available from Mon to Fri 9 am to 8 pm & Sat 9 am to 5 pm)

Conclusion

In conclusion, if you want a credit card that cares for you to build your credit limit, helping you send timely reminders to pay bills on time to avoid unwanted fees, then Onmo Credit Card is the best choice for you.

The priority given by the company to fees, APR transparency, customer-centricity, and offering user-friendly products with clear charges makes it an undeniable choice when compared with multiple options in the market.

The Financial Conduct Authority authorizes the company and operates under the regulations of the Gibraltar Financial Services Commission so that you can trust this company without any doubt.

Also, to apply for an Onmo Credit Card, there are a few strict conditions, as you can get approved easily for this card with a fair credit score and above 18 or 18 years of age.

With all this being said, if you are convinced to apply For one more credit card, you can visit their credit card page and start the application process.

We hope this Comprehensive Onmo Credit Card review helped you get important details about this credit card. If you have any more questions or suggestions, you can ask them in the comment section, and we will help you solve your curiosity as soon as possible.

FAQ’s

How to apply for an Onmo credit card?

You can apply for an Onmo credit card by visiting the official website of Onmo. Head to the credit card page and contact customer care to start the application process.

Can you use Onmo abroad?

Yes, you can use the Onmo Credit Card for transactions abroad. Onmo Credit Card is typically accepted globally wherever Visa cards are accepted. So you can use your card for purchases, payments, and cash withdrawals in foreign countries, both in-person and online, as long as the merchant or ATM accepts Visa.

What to do if your Onmo credit card is not working?

If your card isn’t working, you get in touch with Onmo’s customer care service to get a quick resolution for this issue.

How to Pay Onmo Credit Card’s Bill?

You can pay Onmo Credit Card’s Bill from the Mobile app; for this, you need to log in to your mobile app and head over to the payments section to process the monthly bill.