If any unfamiliar charges like SP AFF* Charge appear on your credit card or bank statement then it can be quite shocking and it opens doors to questions about whether your card has been hacked. However, we also need to make a note that in most cases this charges are legitimate, and we simply don’t remember where we use the card which results in the current charge. In such cases it’s always better to take a little deeper to determine the reason behind the charge.

We observed that SP AFF* & SP AFF SAN FRANCISCO CA charge appears on the credit card or bank statements of so many individuals and they are not able to find out the reason behind it, and if you are also one of them then don’t worry you have come to the right place! this article provides all the necessary information which should help you understand more information about this charge and ultimately give you some peace of mind!

What is SP AFF Charge on your Credit Card or Bank Statements?

This charge comes from Affirm company; this company allows you to shop now and pay later at your own pace without any extra fees with their “Affirm Pay in 4 facility.”

With this facility, customers can choose to pay the bill amount in 4 interest-free payments, which will be auto-debited from their accounts or credit cards, instead of having to pay for the entire online order amount all at once.

Full form of this Charge

- SP – ShopPay (Or Stripe Payment) & AFF – Affirm

So overall, SP AFF means while making the order payment, you must have used Affirm to pay through ShopPay, as Affirm allows you to choose your payment option. (SP could also refer to Stripe Payments, so to get more clarity, you can check which payment method you are using)

We suggest you install the Affirm app so that in the future, if any similar charges show up on your credit card or bank statement, you cross-check it in the app.

What is SP AFF SAN FRANCISCO CA Charge on Credit Card?

SP AFF SAN FRANCISCO CA Charge on Credit Card comes from Affirm company. First of all, we need to know that Affirm doesn’t charge us any additional amount. At the time of payment at shops, you may have used affirm’s service to make the payments; that’s why you see this charge on your credit card or bank statement.

The charge simply means that you have used Affirm to make your payment, which ShopPay or Strip Pay processed. SAN FRANCISCO CA is the location of affirm’s headquarters office.

How can you Report SP AFF Charge?

Now, if you think you have been wrongly charged with this charge; you can immediately contact your bank and raise a dispute against this charge. Many users on Reddit have claimed that they have also done the same, and their bank has refunded their amount.

If you want to speak with Affirm’s customer service, you can visit their contact us page to get your queries sorted. Along with this, here are some details that might be helpful to you –

Affirm Customer Service Number:

855-423-3729

Email IDs:

- help@affirm.com

- cares@affirm.com

Want to close your Affirm account?

To avoid recurring charges on your card that you don’t want, closing your Affirm account is a viable option. Here’s how to do it:

First, note that having an Affirm account won’t impact your credit score. Once you’ve settled your balance and moved any remaining savings, you can proceed to close your account.

To close your account, simply contact Affirm’s customer service care and inform them of your decision. You can find the company’s contact details on their Contact Us page.

How does Affirm Company work?

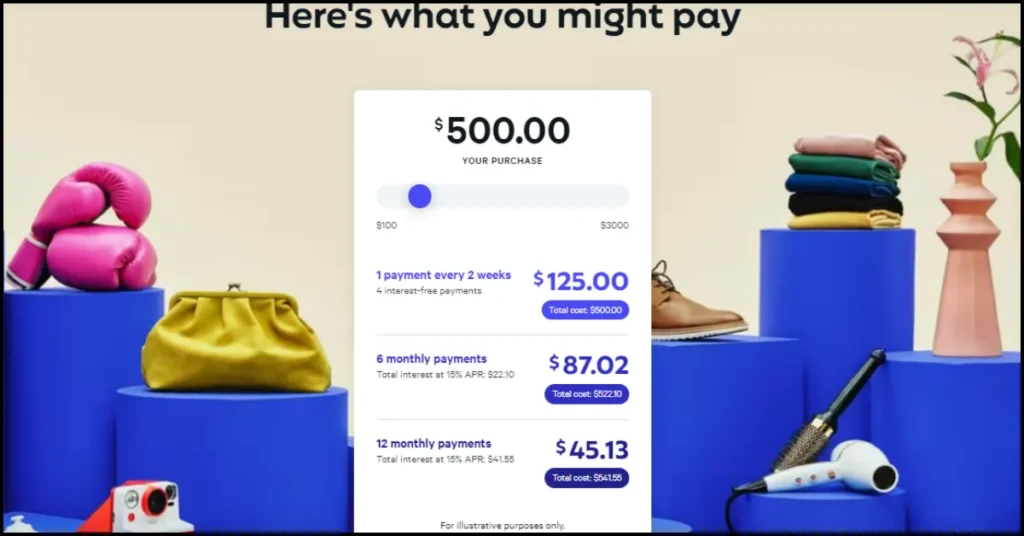

Affirm is one of the Leading companies in the USA offering their consumers a buy now pay later (BNPL) option. The company’s mission is to help customers afford their favorite things they want to buy without carrying unmanageable debt. While making the payment affirm allows you to choose your preferred payment option.

So here’s what the Affirm payment process looks like –

Step 1) – Shop at your favorite online or offline stores and choose the option to pay later with affirm. You can find this option at check checkout. At the same time, you can also Request a virtual card in the Affirm app.

Step 2) – Now, at the checkout page, you can spread out your payments for your purchases under the payments option. Once you choose this option, you must make a small down payment and then aggrade to pay off the rest in installments over a few weeks or months.

So the four installments option means the first installment is a down payment at the time of purchase, followed by the remaining three installments.

Step 3) – You can also manage your payments in the Affirm app or online; as you set up auto-pay for your remaining installments, you don’t have to worry about missing a payment.

Additional info about SP AFF Charge

To get additional information about this charge, you can also take a look at this video.

Also, you can check this Reddit thread where people discuss how they see this on their credit cards.

Read more about other charges – DNCSS CHICAGO BB CON Charge

Conclusion

Finding an unfamiliar charge on your credit card or bank statement can be painful. But in most cases, these charges are legitimate but forgotten. We need to review our recent transactions to understand the reason behind such charges.

So overall, SP AFF Charge is a legit charge from the affirm company. With Affirm’s Pay in Four facility, customers can quickly pay the required amount in four installments, which helps them buy their favourite expensive items without worrying about any debt.

To avoid confusion in the future, consider installing the Affirm app to cross-check recent transactions.

If you believe the this charge is incorrect, please contact your bank to dispute it. Some users have reported successful refunds. You can also contact Affirm’s customer service using the contact information provided.

We hope that this article has given you some clarity to recognize this unfamiliar charge. If you have any questions or suggestions, kindly share them in the comments section, and we’ll do our best to address your queries.

FAQ’s

What does SP AFF mean on bank statement?

Here SP could mean ShopPay or Stripe and AFF means Affirm (which is a loan company)

What is Affirm?

Affirm is a a loan company which offers a buy now, pay later (BNPL) service. With which customers can pay the order amount in four interest free payment option in the form of two weeks or monthly installments.

What is SP AFF charge on debit card mean?

This means you must have used Affirm at checkout and have made the payment through either ShopPay or Stripe Payments

1 thought on “SP AFF* Charge on Credit Card – Legit or Scam? – 2023”