Are you repeatedly getting calls from 855-812-4430 this number, And an automated voice is saying that you have transferred X amount to a John Kramer? Furthermore, you’ll be instructed to press 1. then beware! Scammers can use this scam technique to access your Credit card account.

Many people have reported randomly getting charged larger amounts with the VENMO 855-812-4430 NYUS code on the bank statement. These are the cases in which credit card information is stolen from people and is used for most use of the available data.

This is not a hundred percent scam charge as after you make payments by yourself, the same code also appears on your bank statement, so you always need to know where you are making payments so that when such charges appear on your bank statements, you know its origin.

So let’s understand in this article what methods fraudsters use to steal your hard-earned money!

Why do you see the “VENMO 855-812-4430 NYUS” Charge on your Credit Card?

The charge came from Venmo, a peer-to-peer (P2P) payment service founded in 2009 and has been owned by Paypal since 2012. The Venmo Mobile payment app allows users to easily receive and send money from other Venmo users via their mobile devices. This app is similar to Zelle, Cash App, and PayPal.

You are using this charge because you may have paid or received money from Venmo. Since Venmo provides both debit and credit card options, you may have used any of these cards to make the payment.

If you haven’t made this payment and still see this charge on your card statement, this is an early indication of fraud. In this case, you should immediately contact your card issuer and tell them to cancel it.

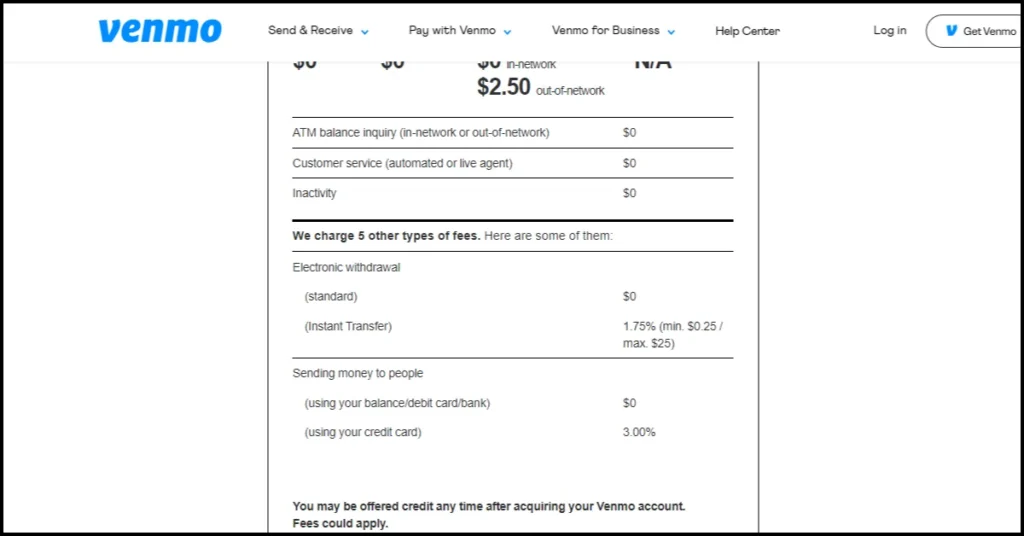

Venmo doesn’t charge any fee for sending money from a debit card, linked bank account, or Venmo account. For are some of the transaction fees charged by Venmo.

- When using a credit card to make peer-to-peer payments, there is a 3% fee per transaction.

- For instant transfers, there is a charge of 1.75% per transaction, with a minimum of 25 cents.

Tactics Used in the VENMO 855-812-4430 Scam Process

Scamsters usually call people from (855)812-4430, which looks like the official Venmo contact number, and that’s why people feel like the call is coming from the company itself.

Once you receive the call, an automated voice will start speaking, saying that you had sent X amount to any random name like John Kramer and that they believed it was a fraudulent transaction, and that you need to press 1 to cancel this payment.

Once you press one key, you’ll receive an OTP, which they will ask you to enter during the call. We strongly recommend to DO NOT ENTER the code because that’s how they will log into your account.

But if you unknowingly share the OTP, the scammers will get access to your credit card information and start stealing your money.

When they start making transactions from your credit card, you get constant notifications for charges wide, Venmo 855-812-4430 NYUS.

Venmo has already made this clear that they never ask their customers for any code to carry out the transaction, so if you ever get a call asking for a code to cancel a failed payment, make sure you don’t share it, as this might cause you to lose all your hard-earned money!

Similar to the Venmo scam, many individuals are falling victim to an unfamiliar charge labeled MICROSOFT REDMOND WAUS. Since it mentions “Microsoft,” it confuses people whether it’s a scam or not. To learn more, please read our article on the website.

Process to Report VENMO 855-812-4430 Charge

Suppose you see that Venmo regularly charges you with the VENMO 855-812-4430 NYUS code, or you’re constantly getting fraudulent calls asking for code for venmo related transactions. In that case, you should promptly block the card to prevent further loss.

If you’re using a Venmo debit or credit card, contact Venmo Venmo’s customer service department, and if you observe such scam activity on another company’s credit card, call that respective bank.

You can connect with Venmo customers from their Contact Us page.

Other Ways to Connect With Customer Service are –

- Send them an email by filling out the form on the Contact Us page.

- Chat with customer care from their mobile app (M-S, 8:00 am–10:00 pm CT, seven days a week) for faster service.

- Connect with them on this number: (855) 812-4430 (8:00 am–8:00 pm CT, seven days a week)

How Does Venmo Work?

As Venmo provides a mobile app for peer-to-peer, or P2P, money transfers and payments, you can easily use it to send payments to each other with emoji messages, and the best part of Venmo is that all of these transactions remain private.

Here’s how Venmo can be used to make payments –

Only available for U.S. customers: As PayPal, a U.S.-based company, owns Venmo, it requires both the sender and recipient to be in the U.S.

Transfers and purchases: With Venmo, you can easily send or request money from anyone with a Venmo account. Venmo can be used for web purchases with e-commerce merchants such as Walmart, Amazon, etc. Venmo has a payment system almost similar to that of Paypal.

Payments from Mobile only: You can only make payments from Venmo from their Android and iOS smartphone apps using iMessage or Siri voice commands. If you want to sign up for a new account, you can do it from their official website or the mobile app.

All Information About Venmo Charges

While using Venmo credit or debit cards, you must also be familiar with their fee/Charges structure. Here’s how Venmo charges for P2P payments and instant money transfers.

1. A 3% Fee per transaction for P2P (peer-to-peer payments) will be funded by credit card.

- P2P payments are funded by the bank account or from a debit or prepaid card, making these payments completely free. Purchases from large merchant brands with Venmo payment options available are also free.

2. A 1.75% fee for instant transfers per transaction, with a 25-cent minimum.

- Like other credit cards, you get charged when you debit money from the ATM. You’ll have to pay this extra charge when you cash your Venmo balance into your debit card.

You can learn more about venmo fees from the fees page on their website.

A lot of people are seeing a strange charge called Relief1 Sandusky OH on their credit cards, even though they didn’t make any purchases. This could be part of a big scam. If you want to know more about it, you should read our in-depth article.

Additional Information about VENMO 855-812-4430 charge

If you want to know how other people got scammed with a similar charge, you should go through these important discussion threads, one from Whatsmycharge and the second from Reddit.

On these platforms, people have discussed how they got scammed and the steps they took to recover their lost money.

Also, if you want to stop getting calls from all scammers, here’s the video for you; from this video, you can understand the steps to avoid scam calls.

Conclusion

So, in the end, we recommend keeping a note of where you are making the payments, so you can easily understand why the VENMO 855-812-4430 NYUS charge is appearing on your bank statements. If that’s coming from a legit transaction you made, then that’s fine.

However, seeing such charges without making any transactions from our end should be taken very seriously, and prompt action is needed to report these charges to the right entity.

Remember that Venmo never asks for codes to carry out transactions or cancel fraudulent payments. If you ever notice any suspicious activity on your card, immediately contact Venmo or your card issuer.

FAQ’s

What is 855 812 4430?

855 812 4430 is Venmo’s the official customer care support number. If you need assistance with Venmo, you can contact their customer care support team using this number. They are available seven days a week from Monday to Sunday, between 8:00 am and 10:00 pm CT.

Why is there a Venmo Charge on my credit card?

Venmo doesn’t charge you any extra if you send money from your Venmo balance or debit card. But if you’re sending money from a credit card, you’ll have to pay a 3% fee over the total transaction amount.

Will Venmo refund money if scammed?

Yes, Venmo will only refund your money if you report this scam within 60 days of discovering it. After raising a dispute, Venmo will investigate this scam and try to recover your funds. Remember, this only applies when you’ve used Venmo properly and didn’t violate their service terms.